Table of Content

Say your home is worth $300,000, and your primary mortgage balance is $200,000. It's easy to see why you might initially favor a HELOC to pay for home renovations. But actually, a home equity loan may be a less risky prospect, even though it gives you less wiggle room upfront.

For example, someone with a home that appraised for $500,000 with an existing mortgage balance of $200,000 could take out a home equity loan for up to $250,000 if they are approved. The interest paid on a home equity loan can be tax deductible if the proceeds from the loan are used to “buy, build or substantially improve” your home. A home equity loan is a loan for a set amount of money, repaid over a set period of time that uses the equity you have in your home as collateral for the loan. If you are unable to pay back the loan, you may lose your home to foreclosure. If you are contemplating a loan worth more than your home, it might be time for a reality check. Were you unable to live within your means when you owed only 100% of the equity in your home?

Cash-Out Refinance

If your career requires continuing education, or you want to return to school to increase your chances of getting a better job, a home equity loan can help you cover the costs. It takes a second lien position and allows you to put your home’s equity to good use. Typically, lenders cap the amount you can borrow to no more than 80% of your home’s equity. Purchasing another home or property via a home equity loan will mean that you must pay a first and second mortgage on your primary residence, plus another mortgage on the new property. But by paying off this debt with a home equity loan, you can reduce your interest rate to 3% to 7%, depending on the loan term.

Understanding how equity works is an essential step in preparing to buy a new home or refinance your current one. By leveraging the equity you build in your home, you’ll be able to consolidate debt, pay for renovations or make updates that increase your home’s property value in the long run. You can refinance for $220,000 and then take the extra $40,000 in cash. You will repay the $220,000 total in monthly payments, with interest.

Investing and retirements

Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate.

A home equity loan is a loan that is given to a person who owns a home. The loan can be used to purchase a new home, or to refinancing an existing home. The downside of a home equity loan is that it can be difficult to repay. Additionally, a home equity loan can also be more expensive to use than a traditional loan. If a company does not have an appraisal, then it does not have any equity.

Apply now

This can give you access to greater funds typically with lower interest rates than other types of financing. You typically have to leave at least 20% equity in your home after doing your cash out refinance, so be sure you have enough equity to accomplish your goals. Let’s say the home you’re selling is worth $220,000, and you've built $70,000 worth of equity in it. If you sell your home for what it’s worth, you'll leave the closing table with a profit.

You can save more money and this can become funneled back into the business. There’s also no guarantee that this business expansion will lead to more profits. Make sure you go over the numbers and weigh the pros and cons before taking out a loan. You can also expand your business with the help of online mortgage lenders. A home equity loan can provide you with the capital you need to grow your company. You could use the money to open a new branch or renovate your store.

Don’t underestimate the importance of balancing your checking account

The average credit card APR is now about 16%, so using a home equity loan to pay off high-interest credit card bills can be smart. Finally, another downside is that youll have to pay closing costs on the home equity loan, which could be between 2% and 5% of the total loan cost. Youll also have to pay closing costs on the home that youre buying.

You may have to spend more money on interest than you would if you were borrowing money from a bank. And, if you don’t use the loans soon, your home may become Foreclosed on. Equity is based on the appraisal, or how a company is valued. Equity is important to companies because it can provide them with a financial cushion in the event of a stock market crash or other unforeseen event. For example, you may not be able to take advantage of the interest rates that are available on home equity loans. Additionally, you may not be able to use the money forventional or down payment assistance if you need it.

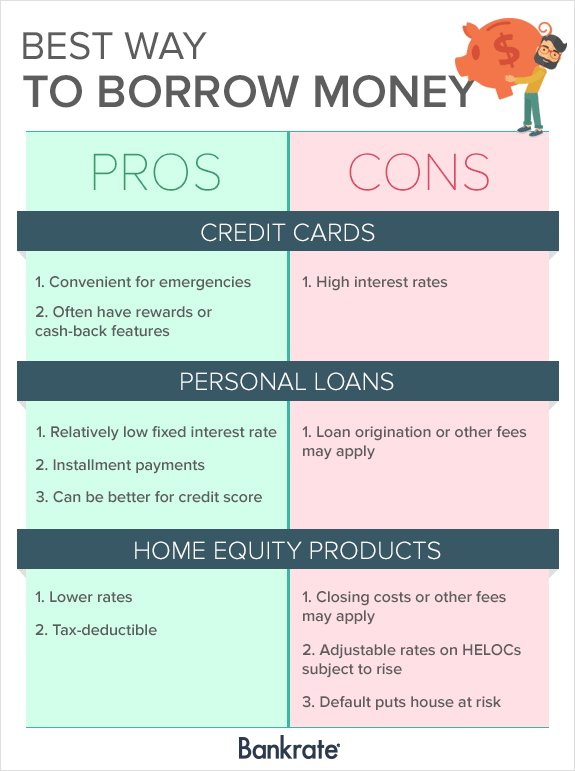

Home equity loans and HELOCs have their own sets of pros and cons, so consider your needs and how each option would fit your budget and lifestyle. Regardless of which type of loan you choose, home equity loan requirements and HELOC requirements are typically the same. Both HELOCs and home equity loans allow you to borrow money from the equity you have in your home.

While HELOCs commonly come without closing costs, they may require appraisal fees and annual account fees for the open line of credit. The number of points deducted will depend on your credit history and profile. It’s because credit scoring firms look at the individual’s total debt. Theres also a limit to the amount you can borrow on a HELOC or home equity loan. To determine how much money youre eligible for, lenders will calculate your loan-to-value ratio, or LTV. Even if you have $300,000 in equity, the majority of lenders will not let you borrow that much money.

No comments:

Post a Comment