Table of Content

- Don’t underestimate the importance of balancing your checking account

- Pros and Cons of Borrowing on Home Equity

- Personal finance for teens can empower your child

- Is Fha Mortgage Insurance For The Life Of The Loan

- Recognize. React. Report. Caregivers can help protect against financial exploitation

- How to Use a Home Equity Loan for Remodeling

- Crypto + Homebuying: Impacts on the real estate market

- What is home equity and how can you use it?

She quickly pivoted toward personal finance, though, once she saw how powerful an impact it had on improving her family's life. VanSomeren has written on personal finance and credit for websites including CreditCards.com, LendingTree, Credit Karma and Forbes Advisor. Home equity loans are secured by a property, which may be subject to foreclosure if the loan isn’t repaid.

With a home equity loan, you borrow a set amount of money and pay it back over time, typically at a fixed interest rate. That fixed interest rate means your monthly payment will be constant over the term of your loan. In a rising rate environment, it may be easier to factor a fixed payment into your budget. Home equity loans and HELOCs allow you to access your home’s equity without changing your primary mortgage’s interest rate. When you borrow with a home equity loan or HELOC, you use the difference between your home’s value and what you owe on your mortgage as collateral. Since they are secured loans, you can often get a more competitive rate with a home equity loan or HELOC than with, say, a personal loan.

Don’t underestimate the importance of balancing your checking account

In the first half of the loan, you’ll make interest-heavy payments and then principal-heavy payments in the second half — this is called amortization. A home equity loan is a loan you take out against the equity you already have in your home. It gives you fast access to cash, with a predictable, long-term repayment schedule.

© 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. Each week, you'll get a crash course on the biggest issues to make your next financial decision the right one. There’s a lot of flexibility when it comes to utilizing your home equity, but the most common uses are home improvement projects and debt consolidation. “This can be valuable for first-time homeowners to finance renovations, or older homeowners to secure their golden years,” says Chris Maloof, president, Go-To Market at MeridianLink.

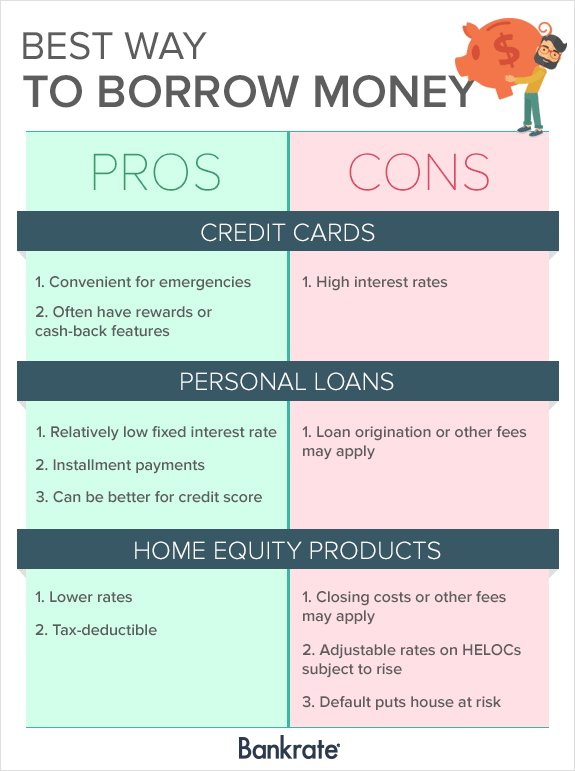

Pros and Cons of Borrowing on Home Equity

The calculation lenders use to determine your loan amount is called a loan-to-value, or LTV, ratio. It’s expressed as a percentage, calculated by dividing your outstanding loan balance by the appraised value of your property. Using your home equity to buy an investment property can be another great way to apply your funds.

Interest rate and program terms are subject to change without notice. Mortgage, home equity and credit products are offered by U.S. You’ll need to already be a Verizon customer in order to qualify for this card, but if you are and you like food, this credit card has surprisingly good benefits. Unlike other credit cards which limit the amount you can earn with gas and groceries, this one doesn’t. The downside is the rewards are rather limited because you can’t redeem them for cash. Store credit cards have some advantages over general-purpose credit cards.

Personal finance for teens can empower your child

It’s one of a few options homeowners can use to access some of the equity they’ve built in their homes without selling. Other options include a home equity line of credit and a cash-out refinance. The Rocket Mortgage Learning Center is dedicated to bringing you articles on home buying, loan types, mortgage basics and refinancing. We also offer calculators to determine home affordability, home equity, monthly mortgage payments and the benefit of refinancing. No matter where you are in the home buying and financing process, Rocket Mortgage has the articles and resources you can rely on. Banks, credit unions, mortgage companies, and savings and loans offer home equity loans.

Next to debt consolidation, home renovations or remodeling is the next most popular reason to borrow a home equity loan. The bad news is that not all uses are smart financial decisions. Here’s what you should know about what home equity loans should be used for. You can use the proceeds of a home equity loan for just about anything, but many homeowners use the funds for the following purposes. You can usually get access to funds quickly, sometimes within days of completing the loan documents. A recent survey found 21% of respondents are considering tapping into their home’s equity in 2023.

Is Fha Mortgage Insurance For The Life Of The Loan

The interest on a home equity loan is only tax deductible if the loan is used to buy, build, or substantially improve the home that secures the loan. Use our Rate Calculator to find the rate and monthly payment that fits your budget. While it varies by lender, Discover Home Loans offers home equity loans from $35,000-$300,000. One example where this is not a good loan use is if you know that you will take on more high-interest debt in the future. Then, you’ll make the most of consolidating your debt by using your home equity.

Some homeowners rack up too much credit card debt and turn to a home equity loan to pay it off. That's a great strategy—if the borrower plans to better manage their credit card usage and spending habits. If they continue their spending behavior, they might put their home at risk of foreclosure. Home equity loans can be attractive options if borrowers are seeking a lump sum of cash upfront. With a second mortgage, you might be able to use the equity you’ve accrued to improve your living space and increase your home’s value.

The lender sees that you are taking the money and investing it right back into the bank’s collateral. If you default, the bank is in good hands because you just improved the home’s value. On the other hand, if you have great credit and a low debt ratio, the lender may not care as much about what you’ll do with the funds. They may still ask, but it may not affect your loan approval status.

It’s why many people who find themselves with a financial emergency use their home’s equity. A TD Bank Home Equity Loan may be beneficial if you also want to get a lump sum of cash from the value in your home after using some of the loan to pay off your existing mortgage. A 125% loan, often used in mortgage refinancing, allows homeowners to borrow more money than the equity they have in their property. Home equity refers to how much of the value of a home an owner controls compared to that controlled by the lender of the mortgage loan. It consists of any down payment made, the portion of the mortgage payment made that pays down the principal, and any appreciation of the value of the home.

No comments:

Post a Comment